Tuesday, June 28, 2011

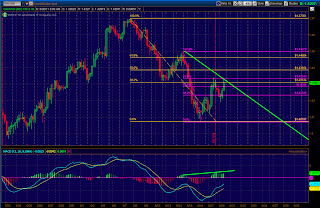

Dollar Index (DX) Important Support 6/28

I figured instead of posting on the euro and stocks and anything else I would just post on what seems to be driving them all at this time. Right now we have just cracked some important support in the dollar index formed by the retracements of the most recent up move (shown in purple) from last week and the up move produced from our lows at 73.665 (shown in yellow). We can see that we are getting a confluence of support between fib levels around 75.516-75.463. We spiked below this brifely and are now sitting just at the lower side of this zone. Whether or not we hold this level I think will ultimatly decide where most markets end up. The most recent spike down has formed some divergence as there was not much move in the MACD on the spike. While the dollar has not made new highs, it has for the most part been making higher lows seen in this chart, and it looks like it is building momentum to break to the upside. If we see a strong break of this current support I would not be short too many markets priced in dollars and would look to 74.845-74.755 for the next major support level.

WTI Crude Oil Rejecting 92.25 Key Resistance. 10:05 AM CST 6/28

(Chart 1 - WTI Crude 60 min)

(Chart 1 - WTI Crude 60 min)(Chart 2 - WTI Crude Daily)

92.25 is a very important level. Today we rallied into 92.19 and couldnt get over it.

Last few hrs on the 60 min chart have very long upper wicks on the candles when it gets near 92.25, indicating continued selling interest at that level.

On the daily chart, 92.25 is also near the low line of the old bearish channel we were in (magenta channel).

I shorted oil here and look for a move back to 90 initially and ultimately a target of 87.50 is very feasible.

Monday, June 27, 2011

S&P (ES) At trendline 6/27

S&P hourly chart is approaching the trendline that was set by the last couple days of action (shown in yellow). We also see we are right at the deep retracement (@1279.75) for our recent down move from the peak wednesday at 1294. Any good formation here and I think it would make for a good selling opportunity, although with such easy resistance found I would not be shocked to see big players push this higher only to see it fall right through the trendline later.

EDIT: Not mentioned in the post or shown in the chart is the fact that the MACD has pulled back to the same height as the previous peak from Friday, while price is a good 5 points lower, not a crazy amount of divergence but there is some.

EDIT: Not mentioned in the post or shown in the chart is the fact that the MACD has pulled back to the same height as the previous peak from Friday, while price is a good 5 points lower, not a crazy amount of divergence but there is some.

Russell 2000 (TF) Triangle forming 6/27

The russell 2000 chart has been forming a triangle (highlighted in purple) over the last few trading days. Usually this would mean we are getting ready to make a break one way or another and at this point I'm not exactly sure which way as all equities seemed to have found strong support where it was expected, but at the same time a strong formation like this is sometimes whats needed to get a trend to continue. Also highlighted is the MACD's triangle formation, which only confuses the picture as there are no real clues in it for which way we might be going.

EUR/USD Heading lower 6/27

It's been a little longer than usual for a post, partially because the markets have been kinda slow and I've been kinda busy at work so with no real wonderful opportunities I just decided to say nothing. It looks like we might be getting a chance to sell the euro short here though as we spiked up this morning and now look to bounce off the 50% retracement of the downmove from 1.45. We also have continuation divergence forming with the MACD as it pulls back farther than price relative to its last peak. The lower time frames are showing some candlestick patterns to enter off of, but I'll wait for this hour to finish to see how it looks.

Thursday, June 23, 2011

S&P (ES) Holds intraday resistance 6/22

After a hard sell off overnight and into the morning session, the S&P has pulled back a good bit from the lows to find its intraday resistance at 1268-1271 range. You can see this is the confluence of the two retracements drawn in purple and yellow. We were forming a nice shooting star through both these levels until the last minute of the hour bar shot up and kinda screwed that up, but I think we still head lower to end the session and back towards the lows.

EDIT: Of course with good greece news breaking right before the close, this doesn't seem like it will sell off to the lows. I have exited my short positions and will let this play out and find a new setup.

EDIT: Of course with good greece news breaking right before the close, this doesn't seem like it will sell off to the lows. I have exited my short positions and will let this play out and find a new setup.

Dollar Index (DXY) Strong But Close to Resistance. 7:04 AM CST 6/23

(Chart 1 - Dollar index daily zoom)

(Chart 1 - Dollar index daily zoom)(Chart 2 - Dollar index daily)

Dollar index is in a macro uptrend (light blue channel)

75.59 is an important resistance (low of a MML trading zone)

This level is also currently the midpoint of the channel

The orange line connecting the recent lows is the "neckline" of a developing head and shoulders.

Here is how I see this playing out:

It will be hard for the DXY to go up much further from here with what lies overhead.

I see it possibly testing 75.78, but then selling off back to 75.

Eventually the orange neckline will be higher than 75, and this will create a bullish wedge/triangle with that line as the low bound, and the trading zone of 75.79-75.98 as the upper bound.

Should we eventually get above 76, then 76.56 is the next major resistance

Should we break that neckline, I think we will retest 74.41, but I believe in the USD short term

Wednesday, June 22, 2011

WTI Crude Oil Update 6:54 PM CST 6/22

(Chart 1 - Crude Daily Chart Zoom)

(Chart 1 - Crude Daily Chart Zoom)92 proved to be very strong support on a closing basis a few days ago. It is the bottom of the current trading range (92.25-95.25) and also coincided then with the low of the current magenta bearish channel crude is currently trapped in.

Where do we go from here is the obvious and important question? Let me start by saying that anything you do in crude at these levels should be kept light and your fades should be wide.

95.25 is the obvious resistance, as we are trapped in this trading range. However, I feel we will breakout a bit to the upside and challenge the midpoint of this channel (dotted magenta line).

I feel anything from 95.25 to this midpoint line will be a good sell for a move first to 93.75, and then an eventual retest of the 92 level. If you find yourself selling at around 97 (where the midpoint line is currently), then consider covering some back at 95.25, as this may be a pullback before we make a run at 100....

I am indecisive because of the hammer candle we put in at the 92 lows and what support it came off of. I feel this rally can be sold. However, I am cautious as that candle on the low of a down move can cause a sharp reversal, and crude always likes to move.

The point at where I begin to seriously doubt the short case is when we close above the midpoint line.

GBP/NZD *REQUEST* 6/22

To the left is a 4 hour chart of the GBP/NZD, and it looks like for the second time in the last few days the pair has broken the previous low mark @1.9857. I don't see a whole lot of setups yet for this pair, but I would try to be patient and sell a retest of the trendline shown in yellow, or play it as a breakout and sell it now, but neither option do I love. In the end I feel there is nothing saying that this pair isnt heading lower in the intermediate to long term future but I dont see a good entry spot for a short term trade.

SnP Resistance Overhead. 6:09 PM CST 6/22

(Chart 1 Daily SnP future)

(Chart 1 Daily SnP future)Sandwich did a post not too long ago here on the SnP as well, but I wanted to get my 2 cents in.

1279.5-1299 is the "trading zone" in MML theory. Essentially, it is hard for price to get in there, and once it is in there for 5 or so days it is hard to get out.

I believe that shorting this area for a move down to 1250 (whose speed is governed by the slope of the bottom of the magenta trend channel) will be a good trade.

A close with any conviction over 1300, and I begin to get bullish however.

Starbucks (SBUX) Straddle update

As an update to a possible trade I had looked at in a previous post, it seems as though Starbucks is starting to test its upper threshold here, as you can see its broken out of the triangle (shown in yellow) that it had been forming and the reason for the trade, and now looks to get out of its regression channel (shown in purple). Should it continue up, the last test will ultimately be its recent highs at 38.21. Right now with where I got into this trade it is up approximately 4% and at this point going to hope we can continue this uptrend even with stocks looking like they might be turning.

Silver (SI) possible buy opportunity 6/22

To the left is an hourly chart of Silver, and there is quite a bit drawn on here. First we have the retracement (in yellow) from its peak in late may (@38.845) to its recent low (@34.4) and you can see we have broken into the first level (@36.098) . Secondly we have the retracement (in green) from the sell off just recently in mid june going to its ultimate lows, you can see we have broken all the way above this retracement and are still holding the 50% line at 36.137. I've also placed a linear regression channel (in purple) of this recent up move. It looks like we are headed towards a lot of support around 36.1, and with us in this purple uptrend channel I feel this could be a good short term buy up to the upper 36 to 37 level. I will be looking for a hammer or engulfing pattern off that level for an entry tomorrow.

EUR/USD In a retracement channel 6/22

It looks like the building divergence we had seen in the eur/usd has finally led to a sell off in the afternoon hours of today as we break to the lower part of the retracement channel shown in yellow around 1.431. So while over the last few days we've been in a minor up trend, I think we have held the intermediate term downtrend and we'll see if the short term trend can be broken by getting out of this channel and headed back towards new relative lows at 1.4072.

S&P (ES) Muddles around resistance, holds 6/22

The S&P hourly chart on the left has been a little worrisome for anyone short the last couple days, and as I had warned in a post a few days ago I thought that we would ultimately reach 1288-1290 before having a chance to head back down. So after hovering around this resistance which was tested a couple other times, but not at all since marking its relative low at 1252.25, we finally start to sell off and seem to have held it. If you had shorted at this level I think it can be held for more opportunity, but if we head back up to 1288-1290 tomorrow I would be weary and ready to get out.

Dolemite waves the white flag...

Well ladies and gents, this is how it goes

After being so so right last week and murdering it on every turn of the market, this week has been a total 180. A good trader would've maximized last week and would've cut all the positions I had this week off days ago.

I've always been a much better analyst than trader.

After being so so right last week and murdering it on every turn of the market, this week has been a total 180. A good trader would've maximized last week and would've cut all the positions I had this week off days ago.

I however, got out consistently early last week when I was right, and held on to and added to everything I was wrong on this week.

Now I am flat all my positions, all of my profits from last week, and full of self loathing..... ah the joys of trading ;)

Good luck out there and I say this to you all as a lesson of what can happen when risk and money management are blocked out by arrogance and greed. This is the number one rule of trading, one I have never been able to get down.......

Tuesday, June 21, 2011

EUR/USD Divergence before Greece vote 6/21

To the left is the hourly chart of the eur/usd pair. When I look at this chart I'm quickly reminded of a previous post of what was happening shortly before Bernanke opened his mouth. Were seeing a slow grind up through resistance with ever building divergence (Seen in green). While we have broken through the top of the intermediate retracement channel in purple, we still are holding the 50% level of the larger retracement. Just to note, the indicator below the MACD on this chart is just a divergence indicator that allows me to quickly identify and scan charts, when either of the lines are below the 0 line divergence is starting to form (although in slow sideways markets it can mean nothing).

Silver Through its 50% Retrace. Shorts Get a Bit Concerned. 7:35 AM CST 6/21

(Chart 2 - Silver 60 min)

(Chart 3 - Silver Daily)

First of all let me say this. I have been short silver for a few weeks now, trading around it a bit, but maintaining a decent core of shorts. Yesterday and last night's action has me a bit concerned. I will not puke yet, but my ears are up and I will look to head to the exits if this continues for a few more days.

35.94 was very important resistance. We are now above that and holding it, and that is what has me a bit worried.

36.33 is minor resistance, but I fear that will not hold.

Should it break, we will run into a major resistance cluster, that must hold for me to stay short.

Look at the 60 min chart.

At roughly 36.50, we have a very strong MML resistance @ 36.53, as well as the bottom of the old bullish channel (light blue). We also have the 62% retrace of the most recent selloff (6/10-14) @ 36.55.

I will add up here.

Here is the problem... I would like to get rid of the entire position if silver trades back into that blue channel, or closes over 36.55. However, look at the daily chart. The down channel (magenta) is the overall governor of current price action. Today's high would be just north of 37 to penetrate it. Therefore, I will keep a loose stop on silver, and use this channel to make my puking decisions.

Hang in there, 1 margin hike or dollar rally is all it takes sometimes.

Monday, June 20, 2011

S&P (ES) Short Caution 6/20

The last few days, piling on shorts on any S&P significant pop has worked out pretty well. But looking at the 4 hour chart it looks like strong divergence is forming and I would be weary of selling in this area. We have another 15 points til we get to the first retracement and major resistance at the 1288-1290 area. At the moment I don't plan on touching this and let it work itself out.

EUR/USD Still Holding Resistance 6/20

To the left is a 4 hour chart of the EUR/USD and while the pair sold off a good amount overnight, it pulled back strong this morning. It seems we are still within the most recent retracement limits shown in purple and still holding the first level (38.2% @1.4312) of the major retracement in yellow. We also see the MACD pulling back considerably on this up move so far without making a new high. This again looks like a good opportunity to get short the pair.

Sunday, June 19, 2011

Natural Gas Finishing it's Pullback? *Request* 6:24 PM CST 6/19

(Chart 1 - Daily Natural Gas Zoom)

(Chart 2 - Daily Natural Gas)

42.4 is the shallow fib of the recent range.

It is also the low of that channel.

I am long because I was early to the party. I was also short a lot of oil and used the early entry as a bit of a hedge.

I will probably add on the open if it stays like this and can develop a short time frame hammer or 2.

I would look for it to go to 4.8 at least and possibly into 5-5.5 if it gets a head of steam

Saturday, June 18, 2011

BAL (Cotton ETF) **REQUEST** 6/18

To the left is the daily chart of BAL, a cotton ETF. Right off the bat when I pulled this chart up I saw the same oil charts I have been looking at for a while with just a few differences. After it sold off from its highs (@117.33) we can see that it recently held the lowest retracement almost perfectly (@93.29) before heading lower and just recently breaking a new recent low. If we do an extension from the highs to lows (@78.37) that were just broken off the held retracement level, we can see we are sitting on the 50% extension now. Oil just recently broke this mark in its charts and I would guess that this will be doing the same very soon. I think this would be a great sell in the 78-76 range that we are currently in. Also to note, like in the oil post I just did, we see a long period of the MACD above the 0 line and now breaking it and retesting the 0 line on the lower side, only to reject it.

Crude Oil (CL) Showing similarities to 2008 6/18

To the left is the daily chart of crude, side-by-side is the 2008 sell off with the 2011 sell off were in right now. I think the similarities are pretty important here, as we look at the 2008 sell off, we can see in the MACD a prolonged time of the MACD being above 0, and showing divergence (shown in yellow) as we reach its ultimate high (@147.27). The same can be seen for the most recent run up to our high (@114.83), and while there are a few other times this has happen, none of them have been met with divergence that sold it off quite like these two examples. Now we look at the MACD on the 2008 chart and see how after breaking through the 0 line, we reject the 0 line twice during the subsequent sell off. Scanning the last 10 years of data, I don't see any other periods where we have a prolonged time well over the 0 line followed by rejects of the 0 line to the upside like we saw in 2008. In 2011 we now have seen the first reject of the 0 line after breaking through it and look to head lower. I think oil is in store for another run lower and going back to an older post a target of at least 85 for the next move.

Friday, June 17, 2011

Starbucks (SBUX) Straddle opportunity 6/17

I know we dont highlight a lot of individual stocks, but heres the Starbucks daily chart to our left, and I think it could be ready for a breakout one way or the other. If I had to guess I think its going south as we form a descending triangle pattern. I think this is an attractive straddle opportunity with historical and implied volatility at relativly low values for SBUX. I'm going to put on an Oct straddle 35/36.

Dollar Index (DX) Finding support 6/17

The dollar index hourly chart to our left, and we can see quite a sell off over the last day and a half. It looks like though it will be coming up upon some support in the previous peak at 75.41 shown in green and the 61.8% retrace of the most recent upmove (@75.411). This coupled with the continuation divergence thats forming in the MACD as it pulls back well below the lows of the previous down peak leads me to believe this might be a good area for a rebound. Waiting for a candle stick formation or a small move up to confirm this support to add on to some of my shorts in other markets.

Silver Presenting Good Sell Entry Right Here? 6:50 AM CST 6/17

(Chart 1 - Silver 30 min zoom)

(Chart 1 - Silver 30 min zoom)(Chart 2 Silver 30 min )

Silver formed a good shooting star on the 6-630 bar right off of the midpoint of the bearish orange channel.

We also broke out of the blue bullish channel to the downside.

We also broke out of the blue bullish channel to the downside.

Read my intermediate view on silver here

As to how to time it, I think here is a damn good entry point. (35.42 currently)

Just remember, you have to possibly stomach a move to just under 36, but I think you won't have to this time.... silver feels heavy this morning.

Thursday, June 16, 2011

Gold Hanging in There, But 1540 Should be Strong Resistance. 7:50PM CST 6/16

(Chart 1 - Daily Gold)

I thought once we got under 1524 we would stay under it. This wasn't the case, and I lightened up my gold shorts.

I am now seeing gold trapped in this macro pennant bounded by the upper magenta line and lower light blue line.

1543 is strong resistance (weak 7/8 MML line).

The top of the pennant is near here as well at this time.

I think any thrusts into 1540-1545 can be sold for a move down to 1523 and eventually to 1504

EUR/USD Pulling back for another sell 6/16

The euro hourly chart to our left, we can see as like most markets today, it didnt do much. What it has done though is pull back to nearly the first retracement shown in purple (@1.4235) and along with that we get a real good sized pullback in the MACD indicator, almost to the level of where it was at the beginning of this recent sell off. While not really continuation divergence, I like seeing the MACD pull back a much higher percentage of the recent swing high than price does. I'd look to sell this around this level or if we pull back any further if you're patient.

Crude Oil (CL) Slow Day 6/16

A chart of the hourly crude oil shown to the left, you can see a zoom up of todays action (if you can call it that). The purple and green lines can be seen in my post from yesterday and what they are. Basically we stayed below the purple line which had provided support for the last few weeks of range trading and above the green line which is the 50% projection of the potential down move. We really saw nothing today, a few attempts to go both ways but nothing interesting and we dont think it can stay in this tiny of a range too much longer, expect a breakout one way or the other.

SnP Chart 1270-1280 Should be Sellable Levels. 6:51 PM CST 6/16

(Chart 1 - Daily SnP Zoom)

(Chart 2 - Daily SnP)

The number 1 thing I am looking at is the bottom line of the magenta bearish channel we broke out of towards the beginning of June. As long as we stay below it, I am a bear. Sure there will be bounces, but you will use those to sell into now.

Should we get down there I will take a good chunk off, as we could bounce to the magenta down trend line again. Eventually, I see us cracking 1250 for an initial test of 1230.5. From there any bounce to 1250 can be sold with pretty solid confidence. (but I am getting ahead of the market haha)

1269.5 is minor resistance. I am going to fade into a short position there, but save bullets for:

1279.5 is very important resistance. It is also right about where this line I talked about earlier is currently in space. If we get at or just above this line, I look to reshort for a move down to 1250.

Should we get down there I will take a good chunk off, as we could bounce to the magenta down trend line again. Eventually, I see us cracking 1250 for an initial test of 1230.5. From there any bounce to 1250 can be sold with pretty solid confidence. (but I am getting ahead of the market haha)

Wednesday, June 15, 2011

Crude Oil (CL) Repeat of May crash? 6/15

On the left is a long term view of an hourly chart for Crude Oil, starting with the sell off in early may from its highs at 114.83 to today's activity. The purple channel is a regression channel drawn from its low after May's sell off to today, with 1st and 2nd deviations shown. We can see its stayed in this channel really well over the last month plus, and the only three times it has broken below (circled in white), it snapped right back and did so well before the markets settled for the day. We notice that today's trading has broken this channel and has sat outside of it now for a good amount of time and settled. I also present the previous two lulls in price preceding the massive sell off on May 5th, highlighted in yellow. While todays preceding price action was quite a bit more than the others, you can see how there is almost no retracement in these moves and just a straight sideways channel until the next sell off, similar to what we are currently forming. With all that said, The green extension is the price extension from the highs @114.83 to the lows of the meltdown, projected off the highs in the channel. We are currently sitting on the 50% projection, and while its a bold projection, I could see oil selling off hard to the 85 level very soon. We've discussed playing straddles or strangles in the option markets on oil, and it looks like that might pay off, and if you are still looking to play this, I would look to cheap option puts on bullish etfs.

Silver at a Crossroads, But Evidence Still Says it is Going Lower 5:25 PM CST 6/15

(Chart 1 - Silver 60 min zoom)

(Chart 2 - Silver 60 min)

(Chart 3 - Silver daily zoom)

(Chart 4 - Silver daily)

After breaking out of the burgundy pennant on Jun 13th, we were weighted heavily towards going lower from there and testing the 34.375 support.

Well, 34.40 is close enough in my book.

Now we have retraced back to the weak MML resistance at 35.94, and the rally stalled again.

Looking at the 60 min chart, we are in a short term up trend (light blue) since we put in lows at 34.40. The highs today stalled at the top of this channel, the 35.94 resistance, and the midpoint of the daily bearish channel (magenta dotted). We had a nice upper wick on that candle and we headed lower.

Short term this channel will govern silver.... However I suspect silver will not be able to get above 36 with any real conviction, and will form a head and shoulders on the 60 min. A subsequent neckline break will then give us the power to get under this bullish channel, back to 34.40, and set up for an eventual test of 32.81, my ultimate support for this phase.

VIX breakout 6/15

After posting a couple days ago that the VIX was showing some consolidation right near the top of its recent channel, it seems that today it finally broke out to the upside and has closed well above the 20 level which it hasnt seen since mid march. Depending on where this opens tomorrow, it might be a good play to try to get in this.

EUR/USD Price Targets 6/15

After the divergence shown in purple on the hourly EUR/USD charts has finally come in, and in a strong way, we start to look for a profit target for this trade. We can see the price extension in yellow for the last major move down, shown projected from the top of the most recent retracement upwards. The 50% level will provide good resistance to the upside as it lines up with the recent low peak (@1.4307ish) and will probably be the indicator to get out. I have pulled a small part of my position off at the open today as butt agaisnt the 61.8% level of the extension, but ultimately we look to target the 100% (@1.4117) in this move. I will be holding the rest until we get there or break the aforementioned 50% level firmly.

S&P (ES) Bouncing off trendline 6/15

The hourly chart formed a trendling (shown in green) from two previous peaks on this march downwards over the last week. After yesterdays break above this and then break below it this morning, we are now testing it on the downside. I think this will be an important area to hold to determine that we continue down today and the next couple days. If you are looking to get short its as good of place as any.

Tuesday, June 14, 2011

EUR/USD Divergence before Bernanke 6/14

I posted yesterday about a possible continuation divergence forming in the EUR/USD pair along with a shooting star, and while it went down momentarily, it has rallied hard overnight and today. I see some divergence lining up from the MACD as we rally all day and think it might be another chance to sell or fade an earlier position. I'll state that this is not a trade for the faint of heart as we could easily see a big move either way with Bernanke set to blab in about 30 minutes.

Snp, Gold, Oil, Silver, All at Key Resistance 9:20 AM CST 6/14

Quick update

Snp september future currently 1281

WTI currently 98.15

August gold currently 1523

July silver currently 35.19

All of these are either just under/over or at very important resistance.

I resold all of them.

Any real move higher from here and I will have some serious thoughts about staying short.

SNP Finishing a Dead Cat Bounce. 1279 Key Resistance. 7:16 AM CST 6/14

(Chart 2 - Snp September future daily chart)

The SnP broke out of its daily bearish channel (magenta) Jun 6th.

Now the bottom of that is important resistance, and personally I don't see us closing back in it.

1279.25 is also very very important. Look at the 30 min chart with the tall upside wicks on the recent candles that are near this area. This shows others are selling here too.

If we run up into 1277-1280, I like the sale for a move down to 1250.

Gold to Continue Lower. 1524 Now Key Resistance. 7:02AM CST 6/14

(Chart 2 - Gold 60 min)

(Chart 3 - Gold daily)

Feels good to be right (especially to the day!)

Hope anyone who reads along shorted with me.

Enough gloating... on to the charts:

We are now under the midpoint of the daily bullish channel (light blue) governing gold.

We are also under 1524, which was good previous support.

I will look to add to my shorts in the 1520-1525 range for a move down to just north of 1500.

I like this because we are in a 60 minute bearish channel (magenta) and any move up in gold will bump into a confluence of the top of that channel and the 1524 level, which should attract selling.

Monday, June 13, 2011

VIX possible upside breakout 6/13

To the left is the VIX hourly chart shown over quite a few weeks of trading, wanted to get the feel of the channel it has formed between 15 and 19+ or so. It looks like most of the times that it has even approached 19 it has come right off that level. Looking at it over the last couple trading sessions it seems like its consolidating near the high of the channels for the first time. I dont know if this is a signal that its ready to break out to the upside or not, but it certainly seems unusual and I wouldn't be trying to short it to go to the other end of the channel this time.

Subscribe to:

Posts (Atom)