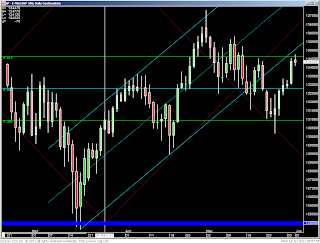

(Chart 1 - Euro/USD daily chart w/ MML resistance drawn)

(Chart 2 - Euro/USD daily chart w/ mMML minor resistance drawn)

I think risk off (aka dollar on) is in effect for a bit.

Euro stayed put all day as stocks got mauled...

Then at like 1 or 2 PM CST it as well as gold oil and other dollar bell weathers got hit.

14405-14424 was key resistance. We got above it and then battled it all day, and at one point even made me think we might go higher in the face of the stock bloodbath.

Once it snapped back under 144, I felt like the short was the right side again, and the close only confirmed it.

I like selling pops today and fading into a short position.

I could see them trying to gun weak shorts out, as it looks like a good sale right now.

14400-14425 should be key resistance again...

Short term targets of 14310 and 14250 and ultimately 14160

(Again, for what Murrey math lines (MML) are, please

google them for some info)